The following table sets out the key operating data for 2014, 2015 and 2016:

| Unit | 2014 | 2015 | 2016 | Rates of change over 2015 |

|

|---|---|---|---|---|---|

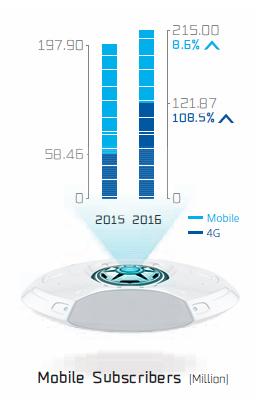

| Mobile subscribers | Million | 185.62 | 197.90 | 215.00 | 8.6% |

| of which: 4G terminal users | Million | 7.08 | 58.46 | 121.87 | 108.5% |

| Mobile voice usage | Million minutes | 655,939 | 667,535 | 720,566 | 7.9% |

| Mobile SMS usage | Million messages | 64,583 | 56,817 | 54,744 | (3.6%) |

| Handset data traffic | kTB | 266.6 | 554.7 | 1,277.0 | 130.2% |

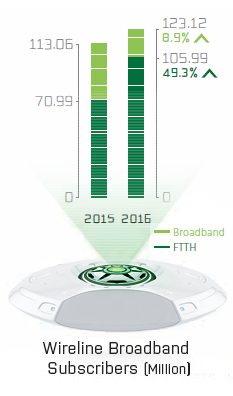

| Wireline broadband subscribers | Million | 106.95 | 113.06 | 123.12 | 8.9% |

| of which: Fibre-to-the-Home (FTTH) subscribers |

Million | 42.61 | 70.99 | 105.99 | 49.3% |

| Access lines in service | Million | 143.56 | 134.32 | 126.86 | (5.6%) |

| Wireline local voice usage | Million pulses | 130,439 | 110,935 | 93,403 | (15.8%) |

| e-Surfing HD subscribers | Million | 31.26 | 40.38 | 61.33 | 51.9% |

| BestPay average monthly active users | Million | - | 3.51 | 16.21 | 361.8% |

| Internet of Things connected devices* | Million | - | 0.98 | 14.19 | 1,348.0% |

| * China Telecom completed the construction of its efficiently-centralised operating platform for Internet of Things and operation commenced in April 2016. |

|||||

In 2016, the Company continued to focus on the “2+5” key businesses with continuous optimisation in business structure, achieving scale expansion, sound revenue growth momentum and remarkably strengthened comprehensive capabilities. Step-up transformation leaped forward to a new level.

Key operating performance in 2016

(1) Healthy growth in operating revenues with continuous optimisation in business structure

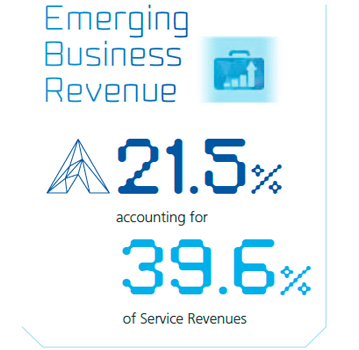

In 2016, the Company’s operating revenues increased by 6.4% to RMB352,285 million. Service revenues increased by 5.6% to RMB309,644 million. Revenue structure was further optimised, with emerging businesses accounting for 39.6% of service revenues, up 5.2 percentage points. Of which, handset Internet access revenue and ICT service revenue increased by 42.9% and 17.2% respectively over last year, becoming the major drivers of revenue growth.

(2) Rapid growth in mobile services with comprehensive acceleration in 4G business

Through persistence in aggressive marketing strategy, the Company implemented sales and marketing initiatives such as “Integration driving new subscribers”, “Seizing card slots” and innovation in consumer finance, driving the rapid development in mobile services with consistent increase in the market share of mobile subscribers. The Company leveraged its 4G network edge to comprehensively promote its 4G business. Rapidly expanding in new subscribers market and accelerating subscribers migration, the Company became the world’s largest LTE FDD operator. Grasping the pattern of value chain development, the Company promoted the “multi-mode” handsets1 as the national standard to strengthen the competitive edges in handsets while expanding its sales radius to enhance terminal-led capability. The Company continuously optimised its product strategy, improved its channel deployment and enhanced its sales organisation, resulting in accelerated subscriber scale expansion and rapid revenue growth. Mobile subscribers reached 215.00 million by the end of 2016, with a net addition of 17.10 million for the year. 4G terminal users reached 121.87 million by the end of 2016, with a net addition of 63.41 million for the year, accounting for 56.7% of total mobile subscribers. Mobile service revenues increased by 10.5% over last year to RMB137,611 million.

1“Multi-mode” handsets represent handsets supporting the six telecommunications standards namely TD-LTE, LTE FDD, WCDMA, TD-SCDMA, GSM and CDMA, which is compatible with all the 4G/3G/2G networks of China Telecom, China Mobile and China Unicom.

(3) Mutual enhancement in quantity and quality of data traffic operation with prominent results

Led by the mutual growth in data traffic volume and value, the Company diversified its products and optimised its 4G packages, and promoted the data traffic products including “spare time package”, “holiday package”, “dedicated data traffic package” and “integrated video card”, resulting in growth in data traffic volume while preserving data traffic value. Leveraging the edge of intellectual operation in Big Data, the Company promoted precision handsets upgrade of subscribers, accelerated subscribers migration from 3G to 4G. The Company focused on “large data traffic producer”, “large data traffic application” and “large data traffic area”, resulting in remarkable data traffic consumption with signature handsets, video applications and in key areas. 4G DOU exceeded 1GB, reaching 1,029MB, while data traffic has become the top growth driver for revenue. In 2016, handset data traffic reached 1,277kTB, representing an increase of 130.2% over last year, of which 4G handset data Internet traffic accounted for 83.1%, representing an increase of 32.4 percentage points over last year. The handset Internet access revenue accounted for 49.6% of mobile service revenues, representing an increase of 11.2 percentage points over last year.

(4) Extraction of high speed fibre broadband value with solid growth in wireline business

Guided by the broadband development strategies of “speed upgrade, content enrichment and brand establishment”, the Company reinforced its differentiated edges in its broadband services driven by Hundred-Mbps products with Gbps products as demo. With the launch of its “smart fibre broadband standard”, the Company redefined service connotation of high-speed broadband service as Hundred-Mbps bandwidth or above. Proactively expanding fibre broadband subscriber scale, China Telecom has become the world’s largest FTTH operator. Building on the fundamental of its fibre network, the Company further developed its integrated services. Through smart home gateway and 4K TV set-top box, the Company introduced four core applications including e-Surfing HD, VPN, family cloud and video call, uplifted high bandwidth threshold and extracted broadband value to stabilise the revenue base of our wireline services, and to effectively compensate the revenue shortfall caused by the gradually declining wireline voice revenue. Net addition of wireline broadband subscribers was 10.06 million for the year, reaching 123.12 million by the end of 2016. Net addition of FTTH subscribers was 35.00 million for the year, reaching 105.99 million by the end of 2016, accounting for 86.1% of the total wireline broadband subscribers. Wireline broadband revenue was RMB76,766 million, representing an increase of 3.3% over last year. Wireline service revenues reached RMB172,033 million, representing an increase of 1.9% over last year. Wireline voice revenue was RMB25,987 million, accounting for 8.4% of the service revenues, representing a decrease of 1.7 percentage points from last year.

(5) Strong momentum in emerging business development with favourable market trend

The Company persisted in adhering to innovation as vitality and grasped business pattern to satisfy the continuously increasing and diversifying demand from customers. The Company strengthened research and development, expedited cultivation and pragmatically promoted its emerging business with remarkable achievements. In respect of Smart Family development, leveraging resource strengths, the Company comprehensively implemented efficiently centralised operations to form and operate the smart family alliance and developed four core applications namely e-Surfing HD, VPN, family cloud and video call in full strength, achieving stable expansion in its subscriber scale. By end 2016, e-Surfing HD subscribers reached 61.33 million, representing a net addition of 20.95 million for the year. In respect of Internet finance development, the Company stepped up emerging business promotion including consumer finance instalments and “BestPay red packet”, with average monthly active users of “BestPay” reaching 16.21 million, representing an increase of 361.8% over last year, and actively participating merchants reaching 300,000, grew by 773.5% over last year. In respect of Internet of Things (“IoT”) development, the Company implemented efficiently centralised operation in business development featured with one-stop acceptance for full range of service, launched the construction of NB-IoT and formed e-Surfing IoT industry alliance with focuses on the scale expansion in key industries such as Internet of vehicles, security monitoring and public affairs, achieving a net addition of 13.21 million connected devices. In respect of cloud services development, adhering to the principles of “cloud network integration, appropriate deployment, reliable security and efficiently centralised operation”, the Company refined the infrastructure deployment of cloud and IDC and launched “e-Surfing cloud 3.0” products in order to achieve industry-leading capabilities in key products such as cloud hosting, cloud storage and private cloud. Revenue from IDC service was RMB15,936 million, representing an increase of 27.9% over last year, while revenue from cloud service was RMB1,500 million, representing an increase of 48.8% over last year. In respect of Big Data development, through supporting precision sales and marketing internally and achieving breakthroughs externally in sectors including transportation, tourism and finance, the Company enhanced its level of operation intellectualisation. Revenue from Big Data service was RMB410 million, representing an increase of 81.4% over last year. In respect of “Internet+” development, the Company published the “Internet+” Action White Paper and prominently enhanced the scale and quality of big orders, remarkably strengthened its influence through scale expansion in industries such as government administration, education and healthcare.

(6) Enhancing channel capabilities by implementing sales and service integration via channels

The Company deepened the promotion of channel operation, effectively expanded the channel scale, refining and optimising the “channel overview” and “superior channel” systems while remarkably enhancing precision sales and service capabilities of the channels. The Company strengthened coordination between direct sales channels, physical channels and electronic channels for market development. Regarding physical stores, the Company expanded the open channels coverage in core business districts, built Smart Family experience stores in urban communities and promoted the establishment of sales outlets for “multi-mode” handsets in rural market. At the same time, the Company initiated cooperation with various industries and widely expanded into the household electrical appliance stores, comprehensively promoting sales and service integration. In direct sales channels, the Company leveraged the edges in big orders development and good customer relations, achieved remarkable enhancement in the volume of big orders and widespread influence in industries including government administration, education and healthcare. In electronic channels, the Company leveraged online stores and mobile online stores service system, with mobile online service app users exceeded 100 million. The Company deepened O2O operating capability and developed extensive cooperation with e-commerce companies, resulting in the conistent enhancement in sales volume of data traffic packages and customer acquisition.

(7) Focusing on “2+5” key businesses with enhancement in customer service capabilities

The Company focused on “2+5” key businesses and reinforced the consciousness of “proactive service and smart alert”, in order to comprehensively improve the level of precision service and intellectualisation level. In respect of 4G services, the Company optimised the data traffic business rules and developed data traffic operation by scenario with pilot promotion of detailed record inquiries for data traffic. In respect of fibre broadband services, the Company implemented innovative service models to promote “pay after installation” in order to enhance end-to-end operation capabilities. In respect of key emerging businesses, the Company explicitly defined service scope and refined service system to solve key service problems. To strengthen customer relations, the Company comprehensively promoted star services and scaled-up bonus points reward. The company continuously enhanced channel service quality, improved service standard of sales outlets and strengthened the service capabilities of new media. In 2016, the Company ranked first in the industry in terms of customer satisfaction in both wireline and mobile Internet access services as assessed by the Ministry of Industry and Information Technology.

(8) Strengthening network capabilities prominently with stable enhancement in operating efficiency

The Company persisted in customer-oriented development strategy with innovation and continuously enhanced its investment structure and optimise resources allocation. First, coordinating and planning for frequency resources, the Company leveraged the differentiated edges of “wide coverage with low frequency, adequate capacity with high frequency”. With the comprehensive launch of the LTE 800MHz refarm, the Company built the world’s largest FDD network and achieved basic full coverage of 4G network. In 2016, the Company added 380,000 4G BTSs, reaching 890,000 4G BTSs by the end of 2016. Second, the Company efficiently promoted the full fibre network construction, consistently optimised network coverage and enhanced network capabilities. The Company added over 65 million FTTH/O ports for the year, reaching 210 million ports by the end of 2016, with basic full coverage of fibre network in the city area of southern China. Third, the Company officially published China Telecom’s CTNet2025 Network Structure White Paper, fully launched intelligentisation of network reconstitution, and officially established open laboratory for network reconstitution. With a more open attitude, the Company carried out tests of new technologies such as SDN/NFV with various parties along the value chain, accelerated the pace of technological innovation. Fourth, the Company endeavoured to promote co-building and sharing to avoid duplicated construction. In 2016, the Company jointly built 4G BTSs with China Unicom, promoted the interconnection of two parties’ primary and secondary trunk networks and coordinated the cooperation demand between southern and northern China, to foster the co-building and sharing of fibre transmission line, effectively saved capital expenditure.

Outlook for 2017

2017 is a crucial year for the implementation of the corporate strategy regarding step-up transformation. Navigating with strong strategy-led, the Company will accelerate the promotion of network intelligentisation, service ecologicalisation and operation intellectualisation to further develop the “2+5” key businesses and forge differentiated edges. The Company will accelerate the promotion of service ecologicalisation surrounding the five service ecospheres. In respect of Intelligent Connection ecosphere, persisting in aggressive strategy, the Company will further expedite scale expansion of 4G and fibre broadband services, proactively expanding in subscribers acquisition, strengthening data traffic operation and servicing customer retention to enhance customer value. In respect of Smart Family ecosphere, leveraging the scale advantages of e-Surfing HD service, the Company will promote new integrated packages with scale deployment in e-Surfing gateway and 4K TV set-top box, and expedite the expansion in applications such as family cloud, VPN and video call, to strengthen Smart Family ecosphere development. In respect of Internet Finance ecosphere, accelerating the promotion of credit consumption model, the Company will expand the scales of gross merchandise value, active users and actively participating merchants in BestPay service, with the introduction of various payment scenarios and enhancement in payment capabilities, to enhance customers’ experience. In respect of IoT ecosphere, accelerating the construction of connection management platform and business vitality platform, the Company will focus on three markets namely smart city, vertical industry and individual consumption and leverage the advantages in 4G dedicated network and low-frequency NB-IoT network to achieve scale breakthrough. In respect of new ICT applications ecosphere, reinforcing the promotion of “cloud-network integration” and provision of platform services, the Company will leverage solid network foundation to build strong cloud platform, with a focus on key industries such as government administration, education, healthcare and industrial Internet, to promote the applications upgrade.

In 2017, the Company will seize the opportunity in refining Big Data platform capabilities on corporate level, to accelerate the promotion of operation intellectualisation. With the largest Big Data capability platform in Asia, the Company will endeavour to establish open mechanism of Big Data capabilities for both internal use and external clients. Internally, the Company will embed Big Data in the production systems including MSS, BSS and OSS. Externally, the Company will enhance its applications in areas including sales and marketing, customer services, product development and network operation, in order to foster the enhancement in quality and efficiency and enhance customers’ experience. At the same time, the Company will leverage Big Data capabilities to deepen internal administration, and elaborate the corporate strategies for better execution. Guided by CTNet2025, the Company will also accelerate the promotion of network intelligentisation. Expediting the network evolution and upgrades, the Company will build three superior basic networks, namely 4G network, all-fibre network and IoT network, providing strong support for the scale development of “2+5” businesses, consistently enhancing the quality and efficiency of corporate development, and fostering the mutual growth in corporate value, customer value and employee value.